Pick Trust: Secure Trust Foundations for Your Construction Endeavors

Pick Trust: Secure Trust Foundations for Your Construction Endeavors

Blog Article

Protecting Your Assets: Trust Fund Foundation Expertise at Your Fingertips

In today's complicated economic landscape, making sure the protection and development of your possessions is vital. Trust foundations offer as a keystone for guarding your wide range and heritage, offering a structured technique to property defense.

Significance of Depend On Foundations

Trust foundations play a vital duty in developing reliability and cultivating solid connections in different specialist settings. Count on foundations offer as the keystone for ethical decision-making and transparent communication within companies.

Advantages of Specialist Advice

Structure on the foundation of trust in expert partnerships, looking for specialist advice supplies invaluable advantages for people and organizations alike. Expert support provides a wide range of knowledge and experience that can assist navigate complicated economic, legal, or critical obstacles effortlessly. By leveraging the proficiency of specialists in numerous areas, individuals and organizations can make informed decisions that straighten with their goals and desires.

One substantial advantage of professional guidance is the capability to accessibility specialized knowledge that may not be readily offered or else. Specialists can use insights and viewpoints that can lead to ingenious solutions and opportunities for growth. Furthermore, collaborating with specialists can aid minimize dangers and uncertainties by providing a clear roadmap for success.

Moreover, expert guidance can save time and resources by improving processes and avoiding pricey errors. trust foundations. Experts can use customized recommendations customized to details needs, making sure that every decision is well-informed and critical. Overall, the benefits of specialist guidance are diverse, making it a useful asset in securing and optimizing properties for the long term

Ensuring Financial Safety And Security

In the realm of monetary planning, safeguarding a stable and thriving future depend upon calculated decision-making and sensible investment choices. Making sure monetary safety involves a complex method that includes numerous aspects of wide range monitoring. One critical element is developing a diversified investment portfolio customized to private threat tolerance and monetary goals. By spreading financial investments across different possession classes, such as supplies, bonds, realty, and commodities, the risk of considerable financial loss can be mitigated.

In addition, preserving a reserve is important to secure versus unanticipated costs or income disturbances. Experts advise alloting 3 to 6 months' worth of living expenses in a liquid, quickly accessible account. This fund acts as a monetary safety and security web, giving comfort during unstable times.

Routinely assessing and changing monetary strategies in action to changing scenarios is also extremely important. Life events, market variations, and legislative adjustments can impact financial stability, emphasizing the importance of continuous evaluation and adaptation in the search of long-term financial protection - trust foundations. By applying these approaches attentively and regularly, people can strengthen their economic footing and job in the direction of an extra protected future

Safeguarding Your Properties Properly

With a solid foundation in place for economic safety via diversification and emergency fund maintenance, the next crucial action is protecting your properties successfully. One efficient approach is property allocation, which includes spreading your financial investments across numerous asset classes to reduce risk.

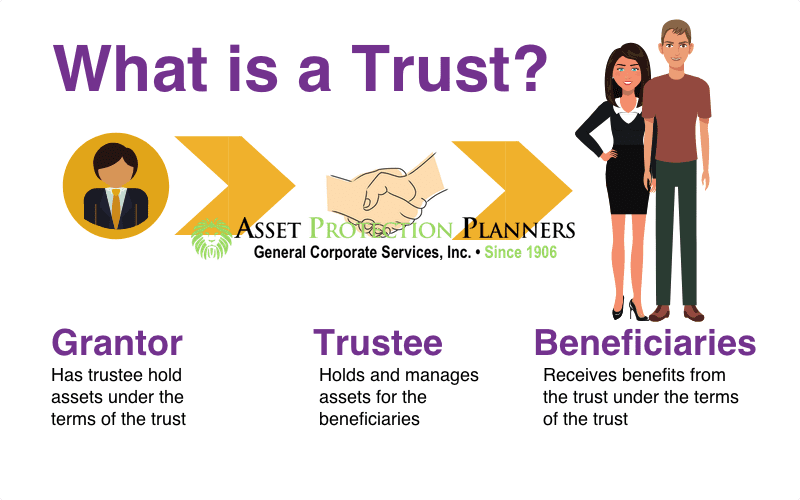

Additionally, establishing a trust fund can supply a protected means to shield your properties for future generations. Counts on can aid you control exactly how your possessions are dispersed, reduce estate tax obligations, and shield your riches from financial institutions. By implementing these strategies and looking for expert advice, you can secure your possessions effectively and protect your financial future.

Long-Term Possession Defense

Lasting property security includes carrying out steps to guard your properties from different hazards such as economic recessions, suits, or unexpected life events. One important aspect of long-term property protection is developing a depend on, which can supply substantial advantages in securing your possessions from lenders and legal conflicts.

Furthermore, expanding your investment portfolio is Read Full Article an additional crucial strategy for long-lasting possession protection. By spreading your investments throughout different property classes, sectors, and geographical areas, you can lower the effect of market changes on your general wide range. Furthermore, regularly reviewing and upgrading your estate strategy is vital to ensure that your properties are protected according to your dreams in the long run. By taking an aggressive technique to long-term property protection, you can guard your riches and supply financial safety on your own and future generations.

Final Thought

In conclusion, trust fund foundations play a vital role in protecting possessions and guaranteeing monetary protection. Expert guidance in developing and taking care of trust frameworks is essential for long-term property security.

Report this page